Do Our Senators Use Our Roads?

March 13, 2017

Road Funding: How a Bill Really Becomes a Law

May 1, 2017What Made the Cut?: Crossover Update

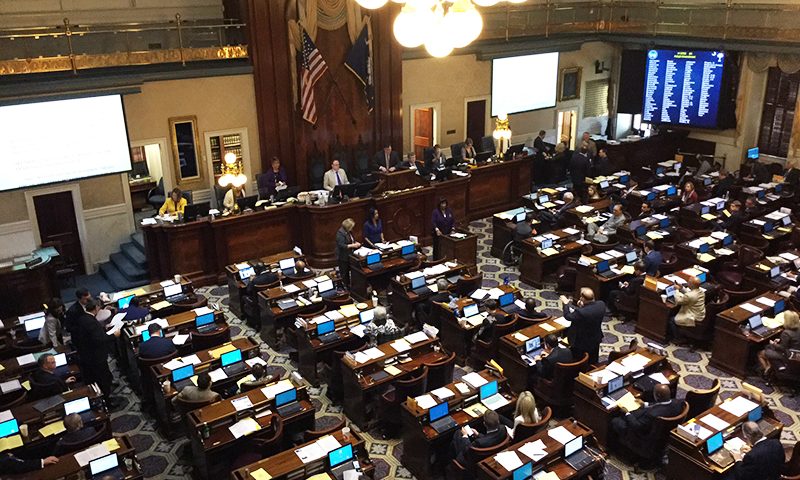

Last Thursday was Crossover Day at the Statehouse. For those of you who don’t know what that is, Crossover Day is the deadline for bills to be passed out of their chamber of origin to the other chamber before the end of session. It’s literally just “crossing over” from one to the other.

To start, we’d like to congratulate the General Assembly and their efforts to get through so many business-friendly bills as possible during this legislative session, despite some obstacles. Obstacle number one was the shortened legislative session – the General Assembly passed a law last year to shorten the session by three weeks. Obstacle number two was waiting for about two months for the transition from former Governor Nikki Haley to Governor Henry McMaster and the game of musical chairs in the Senate that followed.

Yet, despite these delays, many of the Upstate Chamber Coalition’s top priority bills made the crossover deadline. To name a few (okay, maybe more than a few…stay with me):

H. 3516 (road funding) – H. 3516 passed the House 97-18 on March 1st and is currently awaiting debate in the Senate. The bill raises $800 million in new revenue to repair our state’s infrastructure by raising the gas tax by 12 cents over the next 5 years, raising driver’s license and car registration fees, levying a fee on commercial, hybrid, and electric vehicles, and imposing a fee on newly registered cars in the state.

H. 3209 (expungement of criminal records) – H. 3209 just unanimously passed the House this week and is currently awaiting committee assignment in the Senate. This bill expands current expungement laws to include low-level, non-violent acts and applies retroactively so as to benefit those who were arrested or convicted prior to its enactment.

H. 3358 (real ID) – H. 3358 was ratified by both chambers of the General Assembly and is currently awaiting the Governor’s signature. This bill would simply allow South Carolina to comply with the federal Real ID Act, so that South Carolinians can continue to board planes and enter federal buildings and military bases with their driver’s licenses.

H. 3653 (nuisance laws) – H. 3653 passed the House 75-24 on April 23 and is currently in the Senate Labor, Commerce, and Industry Committee. The bill protects manufacturers in rural areas from nuisance lawsuits for noise or smell, when they’ve previously obtained the necessary state and federal permits.

S. 404 (tax credits for high impact companies and agribusiness) – S. 404 passed the Senate 41-1 on March 16th and is currently in the House Ways and Means Committee. S. 404 would allow more businesses to apply for job development credits to foster economic development and give tax credits to food processors using South Carolina farms.

H. 3726 (retirement system) – H. 3726 was ratified by both chambers of the General Assembly and is currently awaiting the Governor’s signature. This bill would make significant changes to employee and employer contribution rates to pump cash into the retirement system’s $18 billion unfunded liability.

S. 105 (automatic stays) – S. 105 passed the Senate 26-6 on March 8th and is currently in the House Judiciary Committee. S. 105 limits contestations in administrative law court against development projects to 30 days, instead of indefinitely halting projects. Objections must prove irreparable harm to the environment for the stay not to be lifted.

S. 114 (non-profit alcohol) – S. 114 passed the Senate 41-1 on March 16th and is currently in the House Judiciary Committee. The bill would simply allow breweries and distributors to donate alcohol to non-profits for events.

In addition to these victories, however, there were some priority bills that did not make the crossover deadline. However, because South Carolina’s legislative session lasts for two years and this session was just the first half, these bills still have a chance next year. Here are some of the important ones:

H. 3650 (business license fees) – H. 3650 has not passed in either chamber and was recommitted to the House Labor, Commerce, and Industry Committee. H. 3650 standardizes business licenses across the state, establishes an online portal through the Secretary of State’s office, and makes revenue changes to adjusted gross income. This bill is highly controversial amongst municipal associations and will likely face amendment as it moves through the General Assembly.

H. 4035 and S. 588 (Angel Investor tax credit) – Both bills were just recently filed (March 22nd and March 29th, respectively) and failed to get a hearing before crossover. Both bills reauthorize the Angel Investor tax credits for six years and expand the state’s credit threshold from $5 million to $10 million.

Phew! We made it through. Although the crossover deadline has passed, there is still much work to be done. While we here at the Upstate Chamber Coalition will continue actively advocating for our top priority bills, you too can make a difference by contacting your state legislators and encouraging them to vote for these bills that made the crossover deadline before session’s end. Your voice matters and can make a difference on these important issues.

Keep on the lookout for vote alerts on these bills and an end-of-session update from your team at the Upstate Chamber Coalition!