Legislature begins work (again) on fixing state retirement system

August 30, 2016

The Overtime Rule: What’s Next?

November 28, 2016The “Off Season” Still Matters to Your Bottom Line

It’s easy to ignore the General Assembly when it’s not in session. It’s easy to think that little is going on this fall but campaigning. Nothing could be further from the truth.

A number of state legislature study committees have begun work this fall on critical issues facing the business community. One is an issue that is a perennial political talking point. The other is an issue that was “fixed” in 2012, only to have the problem get worse in the past four years.

Comprehensive Tax Reform. It’s the Holy Grail of public policy. Could public officials have the strength to withstand the pressures of special interests and populist grandstanders to truly make a tax code that promotes small business and is fairer to everyone? The House of Representatives began work on just that scenario.

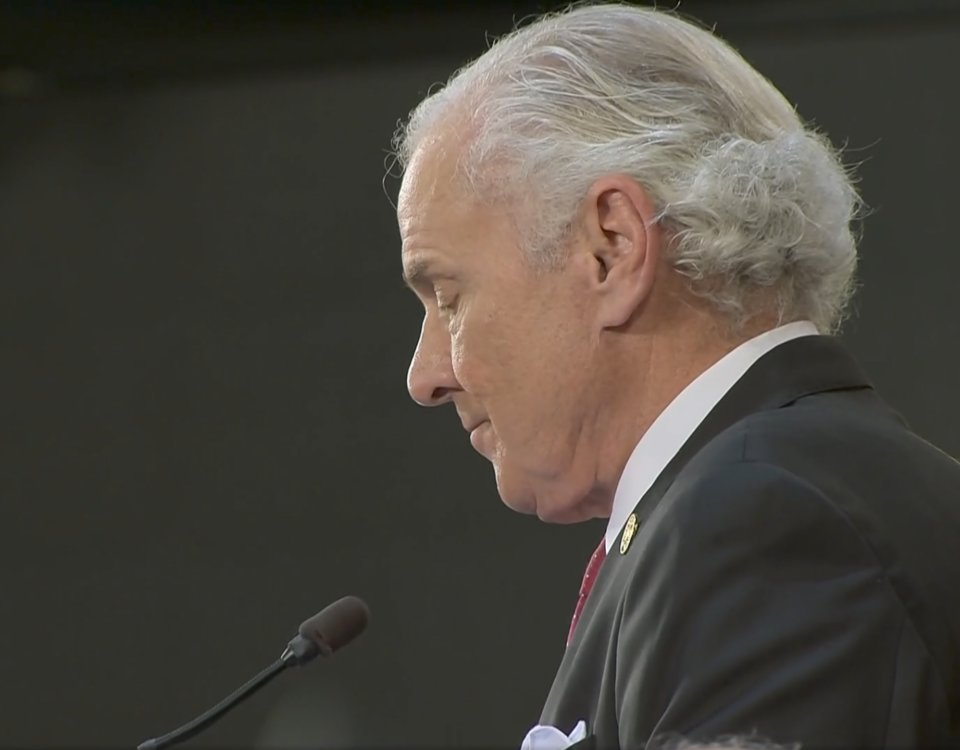

The House ad hoc committee joins a long and distinguished line of tax reform study committees that have produced a distinguished series of door stops for General Assembly offices. This time, a special bi-partisan legislative committee headed by Speaker Pro Tempore Tommy Pope (R-York) is tackling the issue. As I write this column, the committee has mostly heard testimony on our state’s tax situation. A few statistics stand out:

- 5% of taxpayers pay no income tax and 40% pay the highest tax bracket, which has essentially created a two-tiered system.

- 65% of transactions in this state are exempt from sales tax because of all the exemptions and caps.

- In the past 20 years, population + inflation has increased 94% in South Carolina. Commercial property tax revenue collected by local government has increased 316.5%.

Rep. Pope said in an opening statement that he wants to take a look at helping the small businesses who were here “before we were cool” and added, “We need to look at the collateral damage done to small business (as a result of the tax swap in Act 388) and see if there is something we can do.”

Comprehensive tax reform is an issue that has been on the Upstate Chamber Coalition’s agenda so many times – with so little action – that we feel like Charlie Brown kicking a football. This is another promising start, and we will watch this committee’s work closely both to ensure small business’ interests are heard and to assist the committee members in any way we can.

Pension System Reform. Our state’s pension system directly impacts 10 percent of the state’s population. The fix for its massive unfunded liability will impact every bit of our state’s population. A joint House-Senate committee began work in an effort to head off, in the words of the co-chairman, “the biggest challenge we face this decade.”

The state retirement system faces, officially, a $16.75 billion deficit, but private estimates (critical of the official estimate) range as high as $40 billion. South Carolina is not alone in facing such a deficit. Many states are grappling with the twin shocks of more retirees and fewer contributors and investment returns that lag estimates.

“We have a lot of work to do,” said Sen. Kevin Bryant, R-Anderson, the Senate’s co-chairman.

Peggy Boykin, director of the South Carolina Retirement System said that the system is paying out $3 billion a year and only taking in $2 billion – before considering investment returns, which were flat last year. The system has about $27 billion in assets. It doesn’t take a math degree to see how dire the situation is.

The impact on business could be significant. There are only so many places the General Assembly can go to find the funds needed, and most agree that any future increase in funding will have to come from state and local governments in the form of higher employer contributions, catch-up contributions, or diversions of general fund revenues. That would result in cuts to local and state services or higher taxes – barring a major increase in the rates of investment return or state revenues.

Gov. Nikki Haley said in the spring that any fix to the pension system would “hurt.”

The Greenville Chamber and the Upstate Chamber Coalition are committed to engaging in this process to minimize any negative impact to our state’s business community.

Tax reform and any pension system fix could have a major impact on your bottom line. We’re in Columbia watching these issues closely for you so you don’t have to, but we need you to let your Chamber know what is important to you so we can better represent you.

Jason Zacher is the Greenville Chamber’s Vice President of Business Advocacy and Executive Director of the Upstate Chamber Coalition.