Advocacy 101: Meet Ellen Weaver

August 7, 2020

National Issues Forum Agenda

September 9, 2020State Needs To Step Up, Help Small Businesses

This article first appeared in the August issue of Greenville Business Magazine.

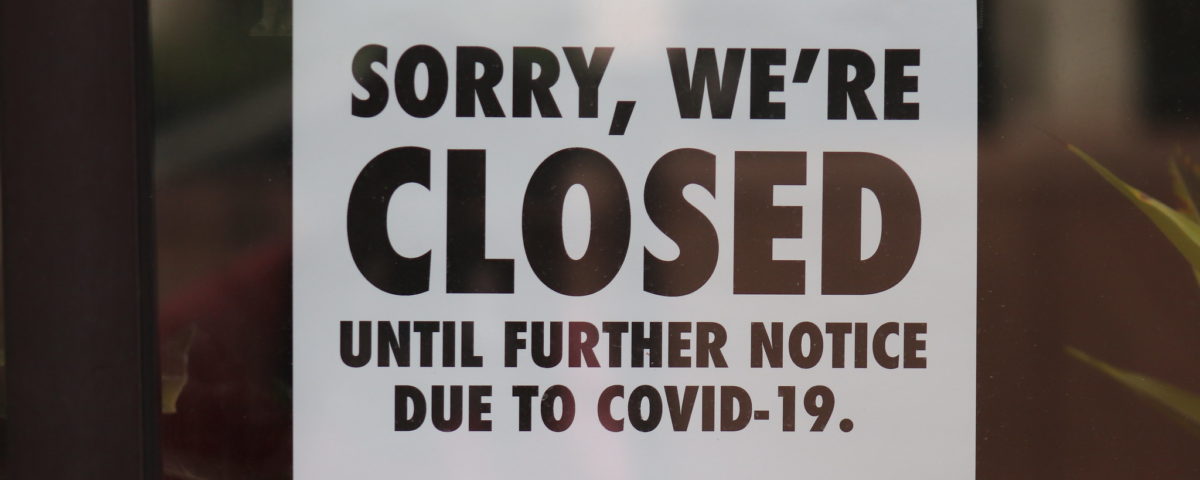

When the first COVID shutdowns were enacted in late March, we all assumed the pandemic would be under control and things would be back to normal by summer.

The major health crisis of the COVID-19 pandemic is only rivaled by the devastating pain it has inflicted on South Carolina’s economy. Few businesses have been spared from the impacts of the virus which spurred emergency declarations and “work or stay home” measures that have precluded businesses of all sizes and sectors from normal operations and revenue opportunities for months.

Our initial projections on a resolution were clearly misguided and the need for assistance for our state’s small-, minority-, and women-owned businesses continues. The CARES Act provided a temporary lifeline for thousands of small businesses, but the economic recovery of communities throughout South Carolina will be thwarted if too many of these small businesses are shuttered due to this pandemic – businesses can best serve their employees if they can re-open.

The General Assembly needs to follow Greenville County’s lead and provide at least $100 million in grants to our state’s small businesses when it returns to session in September. I’m thankful for the leadership of a number of members of the House of Representatives and Senators who have already spoken about such a fund in public debate back in June.

The need for more support for our state’s entrepreneurs is critical. Nearly 3 of 4 small businesses have exhausted their Paycheck Protection Program (PPP) loan, and 21 percent anticipate having to lay off workers once the money is exhausted (according to a recent survey by NFIB). Nearly half of businesses who received PPP funding say they will need more assistance in the next six months – particularly for rent.

In May, nearly two dozen of our state’s small and regional chambers of commerce, along with the National Federation of Independent Business, proposed a plan to provide important resources to re-start small businesses: resources for payroll, benefits, rents, and providing PPE to protect employees and customers. Similar proposals have also been made by our state’s community lenders and other non-profit groups.

In June, the Greenville County Council stepped up and used its CARES Act money to help our smallest and most vulnerable businesses – those under 50 employees. Greenville received more than $90 million in CARES Act and dedicated $75 million for the program. Applications for that program are currently open.

It is no secret that the CARES Act left behind our smallest businesses. Our state’s small, sole proprietor, and minority, veteran and women-owned establishments are a vital part of our economy and a large percentage of those businesses may dissolve without meaningful and accessible relief funding. The economic recovery of communities throughout South Carolina will be thwarted if too many of these small businesses are shuttered due to this pandemic.

There is about $600 million remaining in the state’s CARES Act funding (not assuming any additional funding coming from the new stimulus being debated by Congress as I write this). When the General Assembly returns in September, it should immediately move to establish a statewide relief fund targeting businesses with less than 50 employees and/or generating less than $5 million annual revenue that have experienced economic injury due to the impacts of COVID-19. It is clear the economic consequences will still be felt by tens of thousands of businesses into the fall.

Businesses owned by ethnic minorities, women, veterans and sole proprietors should be encouraged to apply. The funds would be delivered in the form of fully forgivable loans or grants with no obligation for repayment. Businesses would be considered for a grant through an application process with awards granted through a process developed by the South Carolina Department of Commerce or through our state’s community lenders.

Funds must be used for business-related expenses (rents/leases, payroll, PPE or other business restart expenses). Businesses that are found to use the funds for unintended purposes will be required to repay those funds. Additional parameters may need to be established, including guidance on a minimum or maximum grant value available per business, which could help define the potential number of business grants awarded and determine the potential impact to South Carolina’s businesses and economy.

Small businesses will play a vital role in South Carolina’s economic recovery. Our economic recovery depends on small businesses and their employees. Establishing this relief fund will help boost our state’s recovery efforts, help small businesses rebound from the crisis, and be a lifesaver for the lifeblood of our communities.

This article first appeared in the August issue of Greenville Business Magazine.