Advocacy 101 Registration Open

June 30, 2020

USMCA Finally Takes Effect

July 6, 2020DOT Success: Four Years of Infrastructure Funding

In 2016, the General Assembly passed the business community’s top priority by passing new, sustainable, and substantial funding for our crumbling infrastructure.

Today marks Year Four of the implementation, and despite the bellyaching that continues from opponents, significant progress has been made across the state.

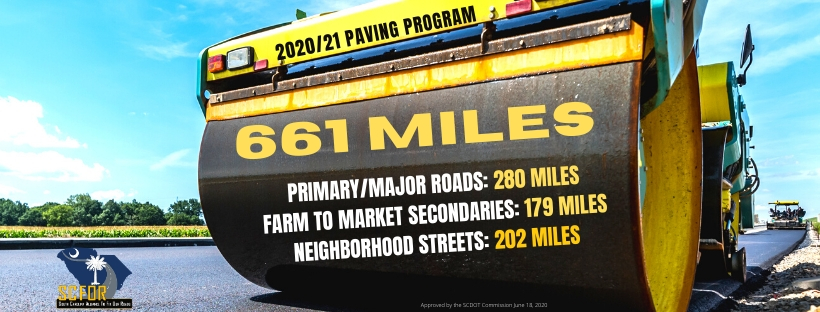

The SCDOT Commission approved the 2020-2021 paving program last week that includes 661 miles of projects in all 46 South Carolina counties. The work is being done, and the DOT is more transparent than ever.

State gas taxes and fees are among the primary source of state revenue for maintaining and improving our roads and bridges in our state. While nobody likes paying higher taxes, as much as one-third of our gas tax is paid by people from out-of-state – making it much more fair to South Carolina residents than other motor vehicle fees (like other states impose).

Our state’s taxes and fees on gasoline and diesel were 22.75 cents per gallon last month. This will increase to 24.75 cents per gallon today. Even after the increase is fully phased in by 2022 – when drivers will pay 28.75 cents per gallon — that will still be significantly less than our sister states and the national average.

- The national average for state taxes/fees on gasoline is 36.13 cents per gallon.

The national average for state taxes/fees on diesel is 37.9 cents per gallon.

These new revenues are being put to work in every county in South Carolina. As the state works to address long-overdue repairs to our roads and bridges, these revenues are the basis for getting that work done. In the Upstate here are the road miles of construction that has been completed as of May 31:

- Anderson: 150.5 miles

- Cherokee: 60.4 miles

- Greenville 129.5 miles

- Greenwood 129.5 miles

- Laurens: 127.9 miles

- Oconee 124.5 miles

- Pickens 75 miles

- Spartanburg 142.9 miles

You can dig in to how all of the gas tax has been spent here. Plus, on that document, you can look at every individual project. You can read the full 10-year plan for road construction here.

The bottom line is that the Upstate has seen almost a thousand miles of road construction in the past four years. That’s a remarkable amount and the DOT should be commended for getting the new gas tax revenue out on the streets (so to speak). This has gone along way toward fixing the concerns of the business community about road safety and load-deficient bridges. Add you can add on to that the plans for increasing capacity on some major thoroughfares (see the 10-year plan above).

And when you see someone criticizing the state for sitting on a pile of gas tax money, you can ask them: “Do you pay your contractors before they complete the work?”